ARTICLE

TU Delft whitepaper Remanufacturing for the maritime industry

Executive summary

Remanufacturing is the act of bringing used product back to its original performance specification, or better (IRP 2018). When comparing to manufacturing, the required material uptake for remanufacturing can be significantly lowered and can drastically reduce production emissions. Applying this recovery strategy to the marine industry offers opportunities to extend vessel lifetime and contribute to decarbonizing the industry. It also reduces dependence on external suppliers of resources and lowers costs.

Circular production practices are becoming the standard in Europe and beyond. New environmental regulations will affect the shipping sector from 2030, aiming to lower the GHG emission intensity of shipping. Lowered production emissions are an additional incentive for the sector to transition towards circular practices. Besides this regulatory driver, there is also a promising business case to introduce remanufacturing into the maritime sector.

This white paper intends to put remanufacturing on the agenda for the maritime sector, define its process and impact, and showcase its value. Business cases are identified for OEM activities and ship servicing and repair, by setting up a remanufacturing process for spare parts that can feed into the operations. Adopting remanufacturing can result in lower costs compared to buying new equipment, lower environmental impact, and contribute to supply chain resilience. Combining remanufacturing with upgrades or (fuel) conversions adds to making marine products future proof in terms of lifetime extension and compliance.

In addition to introducing remanufacturing as a viable, feasible, desirable and sustainable product recovery strategy to the maritime industry, this paper asks for a call for action from regulatory institutions through clear action points.

“The shipping industry is not exempt from the challenges of the energy transition and supply chain disruptions.”

1. Introduction

This white paper was drafted in cooperation with several players in the maritime industry and researchers at TUDelft related to the implementation of the Lean Remanufacturing course developed with support of the EIT- Manufacturing.

It provides a starting point for further discussions on the applicability for the remanufacturing concept in the maritime industry in the light of the upcoming legislation within the field of the circular economy (e.g. Nationaal Programma Circulaire Economie 2023-2030).

Resources in terms of energy and materials are crucial in our society. The climate crisis has increased awareness of environmental issues and led to a need for an accelerated decarbonization of energy sources. All industries have to evolve in their energy and material use to meet new environmental standards and move towards net zero emissions. Geopolitics affects the availability of materials and their supply chains. Some materials required to enable the energy transition that are used for example in electronics are considered critical, which means that their supplies are constrained.

The shipping industry is not exempt from the challenges of the energy transition and supply chain disruptions. The manufacturing of ships and on-board equipment depends on the supplies of metals such as steel and aluminium, and on the critical raw materials used for electronics. In terms of emissions, the global shipping industry accounted for 2.9% of global GHG emissions in 2018 (Faber et al. 2020). The UN Agency International Maritime Organization (IMO) has set an objective to reach a 50% reduction of total annual GHG emissions in shipping by 2050 (Faber et al. 2020).

The shipping sector will be affected by new environmental regulations that will come into force by 2030, such as the Carbon Intensity Indicator, FuelEU and the EU ETS (Faber et al. 2020; European Commission 2021a; European Commission 2021b). The regulations aim to reduce GHG emissions, lower the carbon intensity of shipping transport, and to minimize the pollutants emitted to the local environment. The maritime industry is undergoing a transition towards more sustainable fuels. Current marine fuels will be penalized: operators will have to pay for carbon emissions and high carbon intensity fuels.

From the perspective of material and equipment supplies this means that some ships need to be equipped with new engines able to combust the fuels. At the same time, the supply disruptions are already affecting Original Equipment Manufacturers.

Incorporating circular economy strategies, especially remanufacturing, into the maritime industry can provide stability in terms of equipment supplies and reduce the often-overlooked emissions of raw material mining and manufacturing. Besides environmental benefits, remanufacturing can proof more economical compared to purchasing new original equipment.

2. Circular strategies

resources are used to manufacture products that end up as waste at their End-of-Life. Circular economy means that after the operational life, resources loop back into the economy, to be used again. Waste is therefore minimized, and new material uptake decreased.

Circular Economy. The right side (in blue) applied to the maritime sector. Ellen MacArthur Foundation (2019).

A visualisation of how resources loop in a circular economy is presented in Figure 1 from the Ellen MacArthur Foundation. The finite material loops shown on the right side in blue apply to the maritime sector. The inner loops are the least energy-consuming strategies for circularity, with the least material losses. The further outside the loop, the more energy-intensive the process and the more material could be lost as waste. Here it is seen that recycling is the most energy consuming recovery strategy, and often leads to material downgrade for future use.

Circular use of materials and products promotes sustainable practices. Additionally, it reduces the dependence on external suppliers of materials and products. Circular practices can reduce costs of equipment procurement and maintenance.

In the last years it has become clear that supply chains for primary raw materials and new parts have become more vulnerable. Remanufacturing of existing parts offers the service provider a reduction of risks of such production disruptions. Often, remanufacturing is also a more economical solution in comparison to manufacturing new equipment.

Join our LinkedIn page to stay up to date of our latest development

LINKEDIN3. Remanufacturing

Remanufacturing is a recovery strategy which can be applied by the Original Equipment Manufacturer (OEM), a Contracted Remanufacturer (CR), or an Independent Manufacturer (IM) (Östlin 2008). In this standardized industrial process, used products are restored to their original performance, safety and warranty, or better, using original testing standards (IRP 2018).

The process is initiated by identifying the exact product type and diagnosing the products condition to assess its potential to be remanufactured (Gray & Charter 2007; Ijomah 2010). A number of process steps follow in varying order, depending on the industry and product type. Products are cleaned to remove use traces like oil and dust, after which disassembly takes place to the level of individual parts. These parts are then tested, cleaned and/ or replaced. Re-assembly of sub-modules and the full product takes place in the following step, as well as a final quality test before declared ready for market-release.

An important driver for companies to engage in remanufacturing is that it yields a higher profit margins, as it avoids a new development and manufacturing cycle and lowers material use (Parker et al.2015; Guidat et al. 2015). It is also a known strategy to meet market needs which cannot be met by offering new original equipment, for example, if they have been taken out of production (Guidat et al. 2015). In addition, remanufacturing increases market share and offers the market the opportunity to buy lower impact goods. An often-mentioned strategic benefit is that it offers brand protection (against brokers), reduces resource supply risks, and reduces lead times (Östlin 2008). Remanufacturing has great potential to lower environmental impact of production, however, this is often not the main or single driver (Neto & Dutordoir 2020).

Challenges to engage in remanufacturing are difficulties in aligning supply and demand (Guidat et al. 2015; Ijomah 2009; Östlin et al. 2009). Companies have difficulties with predicting the numbers and timing of product returning from the market. Combined with reverse logistics and remarketing of products, remanufacturing is said to be highly complex (Guidat et al. 2015; Gunasekara et al. 2018). Variety in quality of products returning from the market complicates diagnostics and adds to the accompanied costs (Parker et al. 2015; Guide 2000). From a market perspective, awareness and perception of remanufactured products are often minimal (Abbey et al. 2015; Guidat et al. 2015). But also, the fear of cannibalization of the market for new sales is a major concern (Atasu et al. 2010). From a product design perspective, companies experience a lack of access to product information, like use-history and remanufacturing potential (Parker et al. 2015). Lastly, product’s designs frequently miss alignment with the remanufacturing process or future markets (Parker et al. 2015; Guidat et al. 2015).

4. Relevance for the maritime industry

Remanufacturing is not yet widely implemented in the maritime sector. However, retrofitting vessels is common: the difference is that retrofitting can take place on a ship-level, updating the ship to current standards or even for a new operational purpose. Remanufacturing, on the other hand, is on part, component or equipment level, restoring them to their original performance or better.

There are opportunities for new business cases by adopting remanufacturing practices as a service. Ships often have long lifetimes and even multiple owners throughout their useful life. Equipment and components have to undergo extensive maintenance to support the operations. Remanufacturing complements maintenance activities and is a sustainable option for discarding replaced parts. Remanufacturing could even play a key role in supporting the transition to a sustainable maritime sector, as more equipment becomes available for use.

Remanufacturing can reduce the downtime of a vessel, as remanufactured equipment can be supplied from stock, instead of ships having to undergo extensive repairs at the dock (Jansson, 2016). Remanufacturing reduces generated waste: instead of disposing of components, they are reused and loop back into the supply chain (Jansson, 2016).

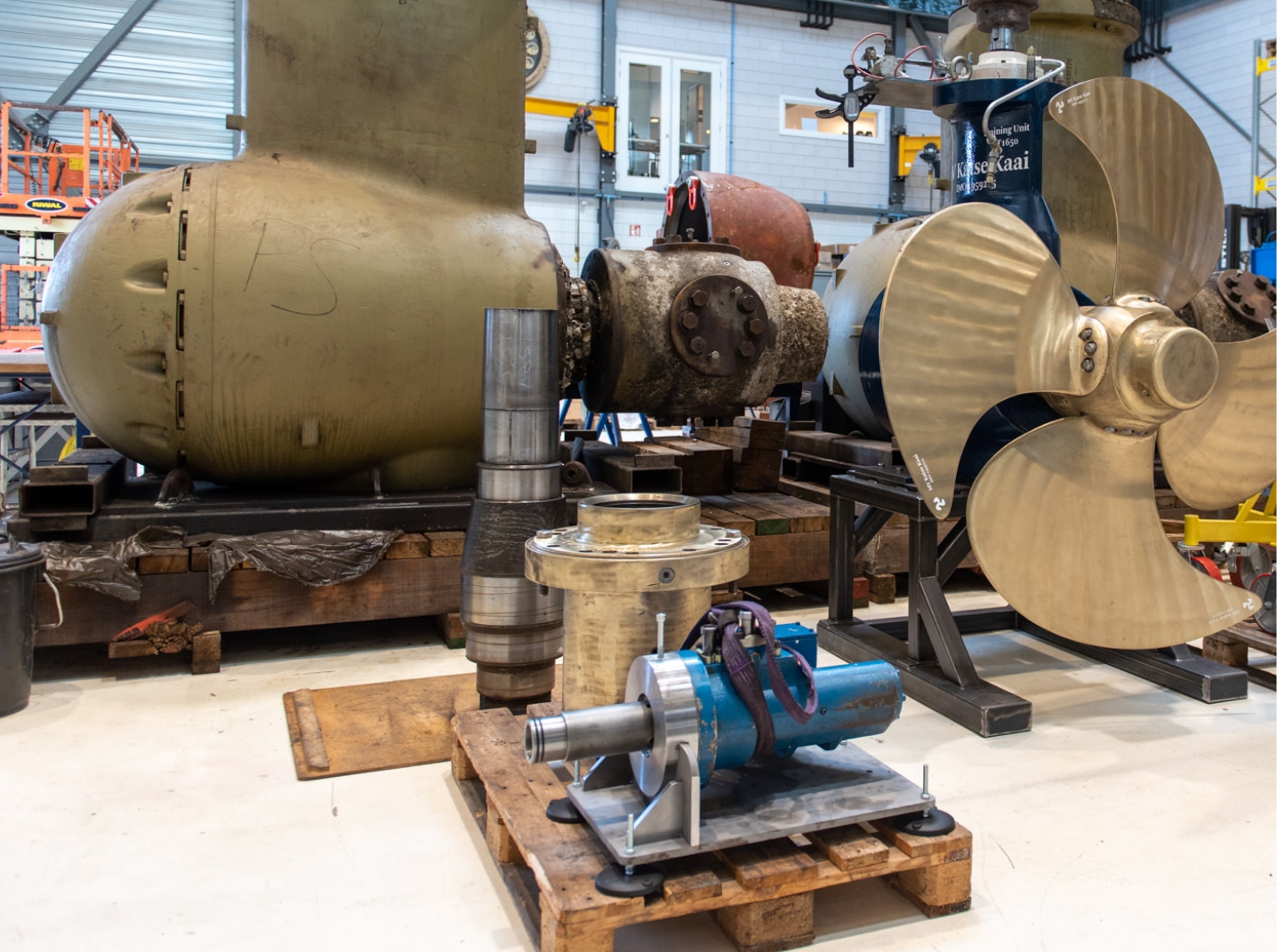

In shipping, the equipment interesting for remanufacturing are high-value components (Wahab et al. 2018; Okumus et al. 2023):

+ Gas and diesel engines

+ Cylinder heads

+ Engine blocks

+ Transmission parts

+ Turbochargers

+ Propeller shafts

+ Stern drives

+ Rudderstocks

+ Stabiliser stocks

+ Z-type drives

+ Marine compressors

+ Pumps

+ Thrusters

Engines and hydraulic systems are considered most attractive for remanufacturing activities (Okumus et al. 2023). The automotive sector is experienced in remanufacturing, and studies in this sector have proven the environmental and economic benefits of remanufacturing diesel engines. Table 1 presents studies that compare remanufacturing to manufacturing of new equipment. The results indicate clear reductions in energy needed for production, in CO2 emissions from the process and cost savings. In general, remanufactured equipment costs are about 50-80 of that of new equipment (Jansson, 2016). Savings in energy and emissions could be up to 90% (Jansson, 2016).

Addionally, remanufacturing requires less new raw materials than manufacturing new equipment. For diesel engines, up to a 98% reduction in steel required is possible (Lui et al. 2014). The raw material demand for remanufacturing depends on the state of the equipment and the extent of repairs that need to be conducted.

Table 1: Remanufacturing benefits compared to manufacturing of new equipment.

| Remanufactured component | Energy reduction | Emissions reduction | Cost reduction | Source |

| Cylinder blocks | 90% | 39% | Afrinaldi et al. 2017 | |

| Diesel engine | 40% | 74% | Dias et al. 2013 | |

| Diesel engine | 70% | 70% | Liu et al. 2014 | |

| Diesel engine | 50% | Okumus et al. 2023 |

5. Stakeholders

There are many opportunities for product recovery in the maritime sector. In small scale, as new components are supplied to ships at sea for on-board repair, old components can be acquired for remanufacturing and later supplied to other ships. During dry-docking and overhauling the potential to exchange old equipment with remanufactured ones is higher.

Overview of stakeholders and connection to remanufacturing.

+ Shipbuilder – buy engines from suppliers for newbuild vessels; engines chosen based on customer needs, price, relationship to supplier

+ Original equipment manufacturer – supply of engines to shipbuilders, supply of spare parts and technical support to operators

+ Ship repair – servicing of vessels, spare parts, repair and overhaul

+ Ship operator – ship owners and operators, purchasing ship services like maintenance and repairs, interested in lower operational costs for use

+ Part brokerage – supply parts and equipment for repair acitivities

+ Classification society – set technical standards for ships, issue classification certificates for ship owners that are required for insurance

+ Port authorities – achieve sustainable growth of port regions and mange port safety, the business climate, water(way) quality and international affairs.

+ Governments, IMO – set regulations for the shipping industry, developing new environmental regulations

+ Universities and research institutes – knowledge building and sharing, optimization of best practices, education

Many engine OEMs are already looking into circular business cases and remanufacturing, including Wärtsila, Caterpillar, Volvo Penta, MTU and Cummins (Okumus et al. 2023). Apart from OEMs, third party remanufacturers can provide component repair to ship owners (ship repair yards). Some sub-components and smaller parts can also be supplied through part brokers. Figure 2 shows how the flow of assets in a remanufacturing eco-system for the maritime industry. Identified opportunities for remanufacturing can encompass various stakeholders: original equipment manufacturers have knowledge of their own systems and are therefore well-positioned to remanufacture engines. Through remanufacturing engines for example could be supplied faster to customers. Shipbuilders can offer leasing contracts for ships, and service them in collaboration with ship repair yards. The latter can also function independently, offering services for smaller maintenance operations and big overhauls. Part brokers can play an important role in promoting remanufacturing and linking remanufactured equipment from stock to customers.

“Through remanufacturing engines for example could be supplied faster to customers.”

6. Barriers and threats

There are barriers in implementing remanufacturing in the maritime sector. Two main barriers for adopting remanufacturing practices are identified in a European setting: lacking policies, and lack of skilled labour force. The lacking policies cover regulations on a higher level, but also part certification. The maritime industry is hardly represented in policymaking when it comes to remanufacturing or even circularity in a wider context (Milios et al. 2019). The future policies and regulations aimed at decarbonizing shipping do not consider the manufacturing phase or the end-of-life of a ship or equipment. Circular strategies are not incorporated in regulations for shipping

(Milios et al. 2019). Additionally, there is no existing certification process by the classification societies for remanufactured components (Okumus et al. 2023). Products in the sector are not standardized, which creates a challenge for remanufacturing processes and certification of equipment (Jansson, 2016). In order to establish and standardize remanufacturing practices, shipyards need to train workforce to (Jansson, 2016; Milios et al. 2019). Currently, as remanufacturing is not widely adopted, processes need to still be developed and adjusted for the maritime sector. Additionally, knowledge around supply chain logistics and part monitoring needs to be built (Okumus et al. 2023). Parts need to be delivered from ship recycling yards to remanufacturing centres, from where they need to be put back in the use cycle (Okumus et al. 2023). However, there are also profitable opportunities, and there is political and legislative pressure to act more sustainably. Retrofitting or refitting often used in the maritime sector. Generally, these mean an upgrade of an existing vessel (Wahab et al. 2018), but it is not clear what happens to the components removed from the vessel. These components have potential to be remanufactured for further use (Milios et al. 2019).

7. Opportunities and business case

Circular strategies can be implemented to cope with constrained material supply, pollutions reduction, and climate – energy shifts. Remanufacturing offers environmental and economic benefits over new original equipment. It can also enable the transition to more sustainable fuels in the maritime sector with lower initial investment.

Business case for remanufacturing service providers

+ Original equipment manufacturer – supply of engines to shipbuilders, supply of spare parts and technical support to operators

+ Maker independent specialized service and equipment providers

Remanufacturing of maritime equipment can be conducted by both OEMs and third-party repair specialists. The business model can be conducted as a service agreement with ship owners or ship operators or as sales of equipment from stock. Through a service agreement the OEM or independent specialist can offer maintenance, repair and overhaul activities, but use remanufactured engine parts instead of new equipment. It allows for shorter docking times for ships if the remanufactured equipment comes from stock. However, such companies can also offer complete installations as retrofit or even for newbuilding. Although a trade in pre-used or reconditioned equipment already widely exists, re-manufacturing offers a much wider application landscape. Under the condition that a set of rules is developed by class, in co-operation with the market, such equipment is brought back and guaranteed to the new building specification. If necessary, installations can also be upgraded to comply with the latest legal or technical requirements. In this way, re-manufacturing offers both commercial as well as environmental advantages, without holding innovation or improvements back. Remanufacturing service is beneficial for both the service provider and the operator. The operational, maintenance or even new building costs for ships can be lowered. The costs are lower, when component lifetimes are extended to multiple use cycles, reducing the need to manufacture and purchase new equipment. It also benefits the availability of installations or parts as it limits the need for the use of rare available materials. OEMs and third-party specialists can also offer remanufactured products through one-off sales, where customers could be shipbuilders, operators that require replacements, or part brokers. In this case again the lead-time could be shorter than for new original equipment, as remanufactured parts can come from stock. In comparison with the existing trade in used or non-OEM parts, the advantage of this process should be that the installation or spare parts are certified by class to be in new build condition.

Business case for engines with fuel conversion

With the upcoming regulations, ship operators need to invest into low-emission fuels. For example, methanol cannot be combusted in existing marine engines, thus operators need to pay for new engines. However, remanufacturing of marine engines with a conversion to alternative fuels offers a possibility to reduce the capital investment required. Simultaneously, older ships can be converted to future fuels, increasing their operational lifetime. Remanufacturing of existing engines in combination with fuel conversion offers a possibility to extend vessel lifetimes while meeting future regulatory requirements, as dual fuel conversions lower the carbon intensity of vessels (Dierickx et al. 2021, Gray et al. 2021). This not only applies to engines, but could be also be valuable for other types of marine equipment. As rules and regulations tend to move to stricter demands and a lower impact on the environment, equipment such as, but not limited to, thrusters, pitch propellers, stabilizers, hydraulic ramps, winches, deck equipment, navigation equipment etc. Are also highly relevant for remanufacturing consideration. Therefore, re-manufactured equipment can play an important role in upgrading existing installations to the latest standards, without having to replace it by a new built unit.

8. Next steps/Action points

Further research needs to be conducted to establish the exact need for remanufacturing and the market potential for the maritime industry. Several suggestions for pathway to implement remanufacturing:

+ Set up the logistics for part supplies, hubs/centres of collection and remanufacturing

+ Identify what is required from the stakeholders, including Knowledge and skills

Research gaps

+ Skill development and knowledge building – equipment manufacturers and ship repair facilities

+ Certification for remanufacturing – classification societies

+ Policies to support circularity – governments and the IMO